Over the years I've saved and studied 1000s of charts and this is the gist of it.

Will reading these lessons help your trading? I think so.

Will these lessons help you master the markets? Yes, if you have the time it requires to implement every step, in a few short years you'll uncover some key nuances that were omitted or not emphasized on the lessons.

Part 1: Shorting climax, it's more technical in the analysis:

http://chalannn.blogspot.com/2014/03/anatomy-of-climactic-setup-with-clues.html

Part III: Apparent capitulation patterns that weren't:

http://chalannn.blogspot.com/2014/10/capitualtion-patterns-that-behaved.html

Part II tries to analyze the action from the psychological side but still full of charts.

There's risk trading these strategies but bigger rewards await the one with a plan to capitalize on them.

Print some charts that you think match both examples and learn the nuances of this capitulation trade on both directions, study and test them before risking your hard earned money on them.

IMO This is the best way to enter stocks in a clear downtrend or to short stocks inside a final parabolic surge. Both trades can be very profitable if executed at the right time but require strict rules that have to be met to qualify the pattern as parabolic with climax

volume exhaustion.

Alan Farley wrote once that price has elasticity and he was right. If price doesn't bounce fast and large within in a few days following capitulation or drops hard and fast following buying exhausting climax be careful because there might be big reasons why big funds are not seeing value and the odds increase with time of another move on the prevailing direction once the big move has been digested. Part III Of the climax lessons gets more in depth on this subject.

Just because you see some stocks higher 20, 40% or 100% Away from their rising 20 MAs on their daily charts or any other time frame, that doesn't make them climactic.

They are moving in a parabolic way but the odds are low they will have a 10-40% drop in a few days as explained in part 1 Anatomy of a climactic trade.

Parabolic moves do drop to their rising 20 MAs but it's a slower and different process.

Parabolic moves without climax offer very profitable short trades if you are patient and willing to wait for the right entry signals, most of the time these pattern will trigger differently, in the form of a 1 Final climax surge. 2 A surprise lower opening gap. 3 A lower high LH Or 2X Top formation. 4 An unexpected violent drop on their daily charts to "encourage" longs to sell fast, after that we must find short entries IF IF IF the bounce is weak.

Using four different time frames I can identify exhaustion volume during the first 30 minutes. This charting program ends the 1st hour at 10 AM EST.

What makes an extended stock climactic is the buying exhaustion that happens at a specific area in the chart described below, it takes place because some participants don't understand that the markets are an auction, large and fast moves need to be digested as early buyers get out having to be replaced by new holders, shorts know this and try to capitalize on the possible quick drop and that battle for the share imbalance takes time.

Most of the time a stock that just doubled in price in a few short days, usually take weeks to move higher again, if at all after a controlled long base.

Or a stock has moved 20% In a few days, enticing new longs thinking that said stock can move another 20% without a long resting period.

Or folks reading on message boards about a possible buyout will quadruple the price of XYZ And they buy it with reckless abandon, of course rumored buyouts rarely take place trapping almost every one willing to make a quick buck fast without a prudent stop lose.

All the above combined with trapped shorts needing to cover their bad entries, all create a huge buying imbalance that when it ends it sucks in all the buyers leaving nothing but sellers.

Inside the auction for every buyer there is a seller but not at the same price, if a large sell order needs to be filled with little or no willing buyers price will move lower until it gets filled, imagine the price vacuum it creates in area where there isn't obvious support technically from where price could bounce.

I'm talking about buying exhaustion from speculation, anticipating much higher prices fast when the forces will push price lower due to the imbalance.

If a new drug becomes the cure for cancer then the sky is the limit on its stock's price as sales will multiply over night, this is a very different scenario. More on that at the bottom of this lesson.

Capitulation at the bottom.

These long trades work most of the time because the massive selling exhausting volume forces all the sellers out thus forcing most professional shorts to cover, price bounces hard because it has little resistance as the move to the downside was fast and fluid, on the way down it had a cascading lower effect that has no resistance on the way up when price begins to bounce.

Buying inside climax or after the first bounce already occurred, measuring both the buying and selling intensity to find a safe entry, once the first wave of profit takers are out.

For this trade to work I'm looking for the biggest red candle with the biggest volume bar on the daily chart and it usually happens after multiple days lower, it has one massive final drop either by a lower open gap or a big red candle < 20 to 40% Away from its declining 20 MA On its daily chart.

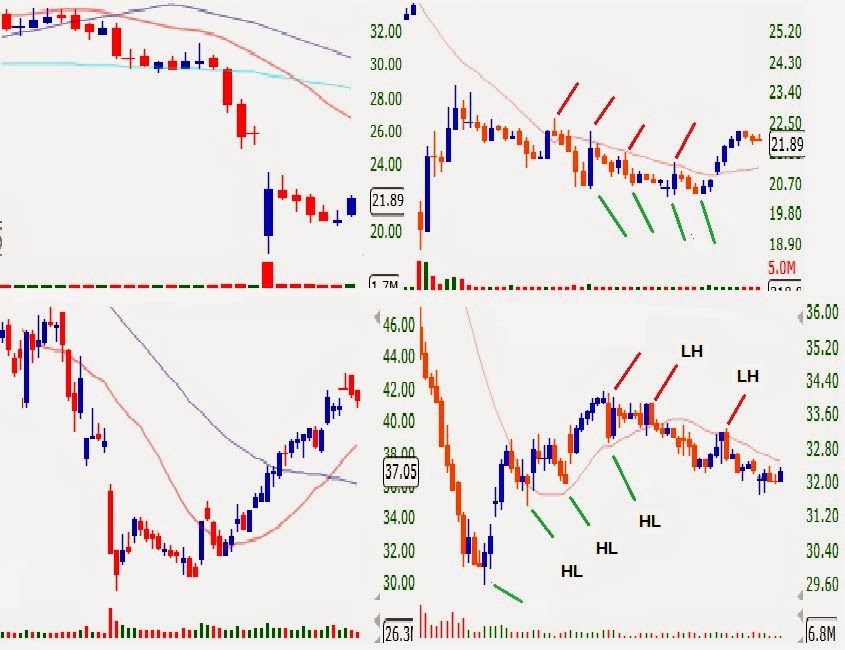

The chart on the top half has SRPT 7 days ago, it formed a climactic bottom with a lower open gap after multiple days down, the lower gap got buyers eager to buy at the open, forming a good size green candle on massive volume that had no follow through next day.

Follow through or continuation higher the very next day is extremely important, a flat open, higher or lower opening gap will test the commitment of all, if it was a great buying opportunity the day before and it opens lower new buyers should step in fast and close the gap because if that don't happen day traders will get out immediately, sending the stock lower, giving pause to potential buyers on the sidelines to wait for lower prices sending the stock much lower, which is a good thing because it removes potential sellers at higher prices, only solid hands will remain holding new shares, once all sellers are out, little buying will form a new higher low bounce on the daily chart.

It took 5 days and a 50% controlled retracement to shake most sellers out.

Amateurs will think that the stock will make new lows but after the massive capitulation volume days earlier there aren't enough sellers for the stock to make new lows because lots of new bargain hunters and investors bought cheap the day it formed the green candle after the gap, once some potential buyers realized that no new lows were made a little buying took it higher six days later.

Lower half TWTR Had a similar climactic pattern but this one had follow through next day and in fact bounced higher for a few days, once it began forming lower highs on the 60 minute chart day traders got out, TWTR Took 12 days of controlled selling until it found buyers and once the higher low was identified it had a huge up day that sent a warning to all shorts that big money was getting long. TWTR Eventually bounced 30% higher.

Disclaimer: Shorting stocks require deep knowledge and a solid trading plan with solid stops in case it moves against you. Recommended only for the seasoned in the markets.

Always keep this in mind. EXTREMELY IMPORTANT.

The other two lessons on shorting parabolic climactic exhaustion, described the momentum chasing crowd creating a big buying imbalance that can last for weeks until the stock reaches buying exhaustion, from pure speculation at the time when some forces are signaling a move in price in the opposite direction due to the share imbalance.

BUT.... There is always a but.

If a drug maker discovers the cure for cancer (Or hazmat suit makers as was the case lately for their manufactures LAKE and APT), then the sky is the limit on its stock's price as sales will multiply over night, this is a very different scenario.

Even then at some point most of the good news will be priced in but at a much higher price than most expect, utilizing these charting techniques to identify tops can help you stay ahead of the masses.

Know this: The higher the % of separation of price versus its raising 20 MA On its daily chart the more attention you have to pay on your long holdings, instead of buying more you should be thinking about selling some.

Shorting parabolic moves require the same criteria as capitulation bottoms but in reverse.

The climactic exhaustion pattern requires the stock be moving higher multiple days and on the day I'm looking to find my short entry it has to form the biggest green candle with the biggest volume bar not only on its daily chart but also in the 15 and/or 60 minute charts, if price is at or near resistance on the weekly chart even better.

Once I see those requirement fulfilled, I have to assume that all buyers that wanted to buy already have bought, and all shorts that needed to cover did so already, so gravity, lack of buyers, professional shorts smelling blood, new longs realizing they are late and by now trapped or about to be, they all react at the same time inside a price vacuum with out support usually collapse price and fast.

The dip buyers will buy the dip but this time the stock will have a weak bounce if at all turning them into more selling fuel or new unhappy investors.

Why would you want to buy and hold the dip following climax other than a quick day trade at an area of a possible technical bounce, when mostly sellers control the future direction?

The chart below shows DDD. After 4 green days, the 5th day just took off, at one point during the day the stock was 15% Higher, it hit 70$, at that price it was 30% Away from its rising 20 MA. On its daily chart but what got my attention was the volume forming on the third hour with the biggest green candle on that time frame and the next volume bar was as big and red creating the climax.

When you see a massive green bar with massive volume after multiple green candles on the same direction, ask yourself who will buy the stock higher from the last buyers? NO ONE.

VJET Below on the same day with very similar pattern, the intra day pullback on this stock the day of the parabolic top wasn't as violent but volume was climactic, so with all long buyers committed and without fresh new buyers, that created a selling vacuum that took six days to find some buyers for a technical bounced but it was weak turning lower continuing more selling.

Below USU Had the same parabolic characteristics, early on the second green day it had quadrupled in price, some folks were screaming for even more gains after that. I warned them of a climactic parabolic move happening at 12$ when I saw the massive volume bar on the 60 minute chart during the 1st hour.

Ask yourself this simple question: Who is going to buy from you if you entered near the top after the massive buying that already took place? The only legit answer is the company being bought by another one, but other than that?

Price dropped 25% Or 3$ to 9$ in the next two hours and I posted on Stocktwits: "If you are under water and the bounce makes you even GTFO"

Because the dip buyers always buy the first drop after a new high and technically the 60 minute chart was in an uptrend but climactic. After violent drops the odds are high of a bounce but weaker and only to form a pivot lower.

USU Bounced the rest of the day only to form a lower high pivot on its 60 min. Chart. Putting the uptrend in question on that time frame. Remember it was so extended on its daily chart after it had quadrupled with exhaustion volume no less.

The chart was screaming trouble for longs and I posted such.

Next day it opened with a lower open gap triggering a stampede of longs that recognized the hourly 2X Top trouble.

The chart below shows a similar 2X Top on the hourly chart that triggered a massive sell off on USU A year earlier.

Look at the separation of price versus its rising 20 MA On its daily chart on massive volume but more importantly the 60 minute chart formed a 2X Top on climax volume putting the uptrend in question.

Next day it opened with a lower opening gap and that ignited the selling because there weren't enough buyers to support price inside gravity, dip buyers that bought the drops were punished if they didn't sell fast.

This chart shows what happened some days latter following the exhaustion moves.

One day wonders?

These are not regular B/Os of 20 or 30% in a day but moves of <70% up moves in one day.

Same requirements apply to these possible exhaustion short set ups. Massive volume on the 5, 15 and 60 minute charts following the extended move, if possible the biggest green candle with the biggest volume on the 60 minute chart to signal exhaustion. After that price needs to drop fast, if it bases tightly it could continue moving higher, after all this is only the first day of the B/O.

The deeper the pullback the more bearish the daily candle will look as seen on the charts below.

For a continuation higher next day price needs to form a tight long base, hold the upper 1/3 -1/4 the rest of day and B/O Higher again next day.

On the chart above of IVAN It didn't have the massive price expanding candle that usually signals the end the move nears on any of its intra-day time frames.

Price got far away from its raising 20 MA On the 60 min. Chart.

But the biggest volume bar highlighted on the 5 and 60 minute charts signaled the buying exhaustion, shorts and seller sent price lower after that, slower but the result was the same by the end of day.

On the chart above: Exhaustion volume on the 60 minute chart will stop a big move, what follows after that depends on how the longs feel about holding longer, depending on some factors such as price making all time highs, near resistance, time of day, length of rally Etc. Etc.

The chart on the left shows the exhaustion volume on the 4th hour (during lunch) the pullback was controlled, two candles later the bulls tried to make new highs but buyers had exhausted earlier remember? After that price fell under its own weight. It formed a 2X top on the 15 minute chart sending a strong signal the big move was over.

Mostly sellers left overwhelmed the small buying.

The chart on the right shows climax volume near a previous top, the ensuing hard pullback explains that some longs were trapped on the previous exhaustion surge that happened the day before, and were happy to get out near break even. See the 2X top marked blue.

The black line separates yesterday and today's action.

***For price to keep moving higher the pullbacks have to be controlled, followed by more potent buying to keep making new highs on ever increasing volume until that exhausts = Climax.

TO BE CLEAR: If you see massive volume on the hourly chart after multiple green price candles, specially near resistance then shorting the stock is the best odds play. BUT BUT BUT. Did i mentioned BUT? If the volume occurs after only one big green solid candle you have to look for entry on the long side because its a new move to the upside specially after a long basing period.

Inside the auction anything is possible, the reason I always use stops is because even after exhaustion volume, if the stock doesn't drop hard but bases instead, it can continue moving higher after a decent basing period creating another short squeeze from professionals who shorted this well known pattern.

Shorting parabolic climactic stocks puts very high odds on the side of the shorts but there isn't a 100% Guarantee that 10 out of 10 will work. Some trades need more than one entry. The odds are very high that price will drop hard and fast BUT, BUT, BUT 2 in 10 will not, they will have a controlled pullback, base and move higher one more time.

If I said 8 Out of 10 work. What about the other 2 you ask?

I recommend using stops all the time.

You can't fight the power of the obvious strength when longs don't want to sell, if price doesn't collapse as explained on the previous lesson using PLUG And TWTR. If price bases instead of collapsing you have to cover your short fast because the odds increase with time of another short squeeze as seen on the chart below:

On the next chart on this day I posted a short trade on Stocktwits during the first 30 minute at 9.80$

But why? The answer is in this lesson.

Few weeks later on DGLY And ISNS:

If you are planning risking your money on these lottery tickets at least have a planned exit or be turned into a long term "investor".

Always buy the breakout never chase fast moving price, the odds are highly against you.

Tip: If you are not familiar with price reading using triangles and other geometrical shapes, learn it, the behavior of triangles on the charts, be it descending, ascending or symmetrical will help you greatly to understand supply, demand relation and analysis.

Very important: The bigger the bounce the bigger the commitment from big holders as seen on the chart below:

If the bounce is weak big $$$ Not fully behind it.

There are many in depth technical analysis lesson explained as simple as possible on the first pages.

Feel free to read them and learn from them before they are gone.

If you have any question or comment feel free to post.

All charts were created with Scosttrade's Elite.

No comments:

Post a Comment